Great healthcare benefits you can actually afford to use

Choose a health plan that provides high-quality care and lower costs.

PLAN COMPARISON

These plans focus on the relationship between you and your doctor so you can stay healthier and keep your costs lower.

Every plan gives you access to quality care from in-person and virtual providers.

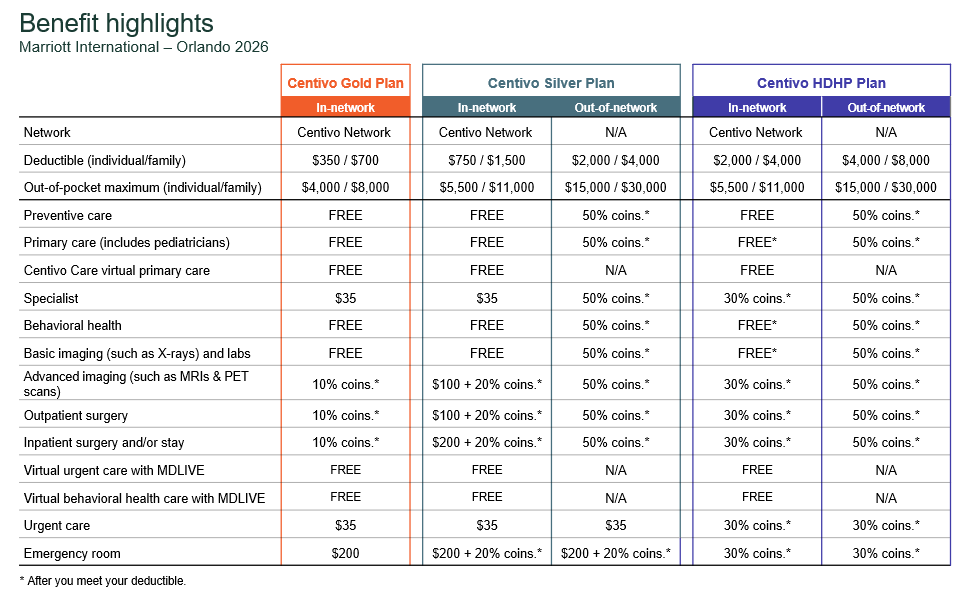

Centivo Gold Plan | Centivo Silver Plan | Centivo HDHP Plan | |||

|---|---|---|---|---|---|

Predictable copays | No | ||||

Deductible | Low | Medium | High | ||

FREE primary care, including pediatricians | After you meet your deductible | ||||

FREE virtual primary care | |||||

FREE behavioral health visits | After you meet your deductible | ||||

High-quality doctors | |||||

HSA-qualified | No | No | |||

Coverage when traveling | |||||

Is a Centivo plan right for you?

If any of these apply to you, you should consider one of Centivo’s plans.

- I want to save $ on my healthcare.

- I see doctors in the Centivo Network and want to continue to see them.

- I’m willing to change doctors.

- I visit urgent care or the emergency room whenever I need care.

- I want to know what I owe – if anything – before I go to the doctor.

how it works

Take these steps to get the most from your plan

Pick a doctor

- Choose a primary care doctor, a step Centivo calls activation.

- If this is a new doctor, schedule an appointment so they can get to know you and your healthcare needs.

See your primary care doctor first for any healthcare needs

- Your primary care doctor can help you stay as healthy as possible.

- When you get sick, your doctor can identify the issue and start treatment.

- If you have ongoing conditions, your doctor can help you manage them and make medication adjustments.

- If you need to see a specialist, your doctor can help coordinate your care.

Understanding key insurance terms

The amount you pay out-of-pocket before the plan pays towards your healthcare costs. With the Centivo Gold and Centivo Silver plans, some care is available for a set copay before you meet your deductible.

A fixed dollar amount you pay for a healthcare service or visit.

The percentage of costs you’re responsible for after you meet your deductible. If coinsurance is 30%, you’ll owe 30% of the cost after you reach your deductible.

The most you’ll pay for any covered healthcare expenses during the plan year.